Webinar: Trust Planning in a High Exemption Environment

March 18, 2021

9:00 am - 10:00 am

Location: Zoom

About the Program: During this presentation Nolan will discuss several estate planning strategies that he regularly discusses with his clients to reduce the tax burden on future generations who potentially will inherit significantly-appreciated assets. In his presentation, he will provide brief historical context to illustrate why now, more than any other time is the time to advise clients seriously consider making changes to an estate plan if a client has a net worth in excess of the current gift, estate, and GST exemptions, or assets close to the reduced exemption levels. This presentation will provide a deep dive into several, trust-based strategies to take advantage of this unprecedented opportunity.

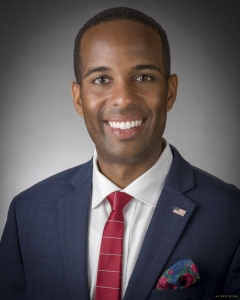

About the Speaker: Nolan James is a business and estate planning attorney with the Cleveland law firm of Cavitch, Familo & Durkin Co., L.P.A. in his law practice, Nolan serves as a strategic advisor for individuals, families, and closely-held businesses on legal matters ranging from estate and asset protection planning, to business succession planning, mergers, acquisitions, divestitures and tax planning. Nolan earned his J.D. and M.B.A. degrees from the University of Akron School of Law and College of Business Administration. He received his undergraduate degree from Spring Hill College, in Mobile, Alabama. Born and raised in Cleveland, Ohio and a proud graduate of St. Ignatius High School.

About the Speaker: Nolan James is a business and estate planning attorney with the Cleveland law firm of Cavitch, Familo & Durkin Co., L.P.A. in his law practice, Nolan serves as a strategic advisor for individuals, families, and closely-held businesses on legal matters ranging from estate and asset protection planning, to business succession planning, mergers, acquisitions, divestitures and tax planning. Nolan earned his J.D. and M.B.A. degrees from the University of Akron School of Law and College of Business Administration. He received his undergraduate degree from Spring Hill College, in Mobile, Alabama. Born and raised in Cleveland, Ohio and a proud graduate of St. Ignatius High School.

Continuing Education – FPA NEO will request credit for this program, which will offer one hour of CE from the CFP® Board of Standards for CFP® designation holders. A general certificate of completion and one for CPA designees who feel the program satisfies their continuing education requirements will also be available. You must be attentive on the webinar for at least 50 minutes of programming to receive credit.

Reservation Policy – This webinar program is complimentary and all attendees are encouraged to register in advance to ensure there is time to receive appropriate webinar login credentials.

Add this event to Outlook Calendar.

Add this event to Google Calendar.

See all upcoming events.